Credit cards are essential tools for managing modern finances, but choosing the right one can feel overwhelming. The perfect card aligns with your financial goals, spending habits, and lifestyle.

Finding the right credit card isn’t just about numbers—it’s about empowering yourself to make smarter financial decisions that reflect who you are and what you value. Imagine earning rewards every time you make a purchase, enjoying special perks while traveling, or simply feeling secure knowing you’ve chosen a card that supports your goals. Your credit card should be more than just a payment method—it should work for you, enhancing your lifestyle and helping you reach your financial aspirations.

This guide will help you navigate the key criteria to consider, match your card with your spending style, and understand your personal requirements. Whether you’re new to credit cards or looking to switch to a better option, these steps will simplify the process.

1. Understand Your Financial Goals

Before diving into credit card options, it’s crucial to identify why you need a credit card. Your financial goals will play a significant role in determining which card is best for you. Some common goals might include:

- Building or improving your credit score

- Earning rewards like cashback, points, or miles

- Financing large purchases with 0% interest introductory offers

- Accessing travel perks or discounts

- Maximizing everyday savings through card-specific deals

Your lifestyle plays a significant role in determining the ideal credit card for you. If you’re a student, prioritizing a card with a low or no annual fee and attractive introductory offers—such as 0% APR or cashback on everyday purchases—can help build your credit while keeping costs manageable. For business owners, a card designed with business-specific benefits is invaluable. Look for features like expense tracking, enhanced cashback or rewards on business-related purchases, and even access to financial tools that streamline operations. For those who are frequent diners, a card that offers dining rewards, cashback, or exclusive discounts at restaurants can turn every meal into a rewarding experience.

2. Lifestyle

- Student: If you’re a student, a card with a low annual fee and introductory offers can be a good option.

- Business Owner: If you’re a business owner, a card with business-specific benefits like expense tracking or rewards on business purchases can be helpful.

- Frequent Diner: If you dine out often, a card with dining rewards or discounts can be a great choice.

3. Evaluate Your Spending Habits

Your spending style is one of the most important factors in choosing the right credit card. Analyzing where you spend the most money helps align your card benefits with your lifestyle.

- Frequent travelers: Look for travel rewards cards that offer points or miles on airlines, hotels, and related purchases. These cards often come with additional perks like free checked bags, priority boarding, and travel insurance.

- Everyday spenders: If most of your budget goes toward groceries, dining, or fuel, cashback cards might be ideal. Some cards offer higher rewards for these categories, giving you a significant return on your daily expenses.

- Big-ticket shoppers: If you occasionally make large purchases, consider a card that offers 0% APR on purchases for a specified period. This can allow you to pay off purchases over time without accruing interest.

- Online shoppers: Cards that provide higher rewards for e-commerce, entertainment subscriptions, or online services might be more suitable.

4. Determine Your Credit Score

Your credit score will directly impact the types of credit cards you qualify for. Knowing where your score stands can help narrow down options and avoid unnecessary rejections.

- Excellent Credit (750+ FICO): If you have excellent credit, you’ll likely qualify for premium credit cards with the best rewards and perks. Cards with generous travel rewards, cashback programs, and lower interest rates are often available to you.

- Good Credit (670-749 FICO): People with good credit can still access a wide variety of cards with decent rewards. Although the perks may not be as extensive as premium cards, you can find solid cashback or travel cards.

- Fair or Limited Credit (580-669 FICO): If your credit history is limited or you’re working on improving your score, your options may be more limited. Secured cards, which require a cash deposit as collateral, can help build or rebuild your credit.

- Poor Credit (Below 580 FICO): If you have a low credit score, look for cards specifically designed for rebuilding credit. These might include secured credit cards or cards with a lower credit limit.

5. Compare Credit Cards Fees and Interest Rates

Interest rates and fees can significantly affect the overall value of a credit card, especially if you carry a balance or plan to use specific features regularly. Always check the following costs before making a decision:

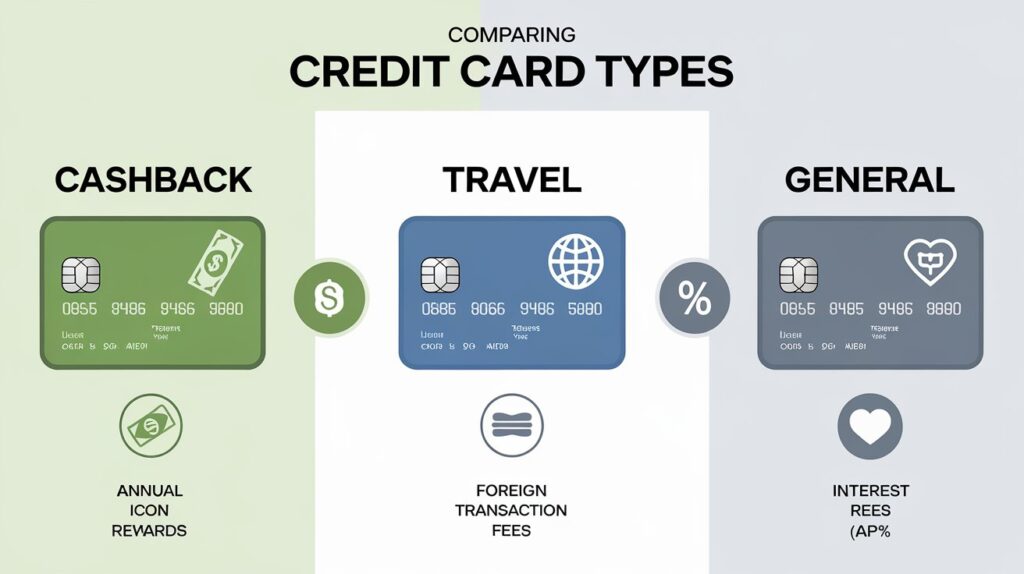

- Annual Fees: Some credit cards charge an annual fee, but they often come with superior rewards and benefits. If the rewards outweigh the cost of the fee, it could be a good investment. However, if you don’t plan to utilize the card’s premium features, a no-annual-fee card might be a better choice.

- Interest Rates (APR): The Annual Percentage Rate (APR) is the interest you’ll be charged on unpaid balances. If you carry a balance from month to month, look for cards with a low APR or consider a 0% introductory APR card. If you pay off your balance in full each month, the APR might be less critical.

- Foreign Transaction Fees: For travelers, foreign transaction fees (typically 1-3%) can add up when making purchases abroad. Look for cards with no foreign transaction fees if you plan to use your card internationally.

- Balance Transfer Fees: If you’re looking to transfer a balance from one card to another to take advantage of lower interest rates, be aware of balance transfer fees, which are usually 3-5% of the transferred amount.

- Late Payment or Penalty Fees: Missing payments can result in hefty late fees or penalty APRs. Some cards offer forgiveness for the first missed payment, while others are less lenient. Make sure to know the penalties before committing.

6. Decide Between Cashback or Travel Rewards

Most reward cards fall into one of two categories: cashback or travel rewards. The best option depends on your lifestyle and preferences.

- Cashback Rewards: These cards offer a percentage of your spending back in cash, either as a statement credit, direct deposit, or check. Cashback cards are perfect for people who want straightforward rewards and don’t travel frequently. Popular cashback structures include:

- Flat-rate cashback: Earn the same cashback percentage on every purchase (e.g., 1.5% on all spending).

- Tiered cashback: Earn higher cashback rates on specific categories like groceries or gas (e.g., 3% on groceries, 1% on everything else).

- Rotating categories: Earn higher cashback in categories that change each quarter (e.g., 5% on dining one quarter, 5% on travel the next).

- Travel Rewards: These cards earn points or miles that can be redeemed for flights, hotels, and other travel-related expenses. Travel rewards are ideal for frequent travelers looking to maximize the value of their trips. Many travel cards offer:

- Transferable points: Points that can be transferred to airline or hotel loyalty programs, giving you flexibility in redeeming your rewards.

- Statement credits for travel: Use points to offset travel purchases made with the card.

- Travel perks: Many travel cards come with additional benefits like lounge access, free checked bags, or priority boarding.

7. Analyze Card Perks and Benefits

Beyond rewards, some credit cards offer perks and features that can add significant value. Depending on your personal needs, consider these additional benefits:

- Travel Insurance: Some cards provide travel insurance, including trip cancellation coverage, baggage delay, and emergency medical evacuation. This can be a huge bonus if you travel frequently.

- Purchase Protection: Many credit cards offer purchase protection, extending warranties on items bought with the card or covering damaged or stolen items for a certain period after purchase.

- Airport Lounge Access: Premium travel cards often include complimentary access to airport lounges, providing a more comfortable pre-flight experience with food, drinks, and workspaces.

- Concierge Services: Some high-end cards offer 24/7 concierge services, helping you book restaurants, hotels, or entertainment.

- Cell Phone Protection: Some cards offer cell phone protection when you pay your phone bill with the card, covering damage or theft.

8. Consider Introductory Offers and Bonuses

Many credit cards offer sign-up bonuses or promotional offers that provide extra value in the first few months. These bonuses can be a deciding factor when choosing between two similar cards. Here’s what to look for:

- Sign-up bonuses: Many reward cards offer bonus points or cashback after meeting a minimum spending requirement in the first few months (e.g., “Earn 50,000 points after spending $3,000 in the first 3 months”).

- 0% Introductory APR: Some cards offer 0% interest on purchases or balance transfers for an introductory period, typically between 12-18 months. This can be useful for financing large purchases or consolidating high-interest debt.

- Balance Transfer Offers: If you’re carrying a balance on another card, look for cards with a low or 0% introductory rate on balance transfers. This can save you money on interest payments while paying off existing debt.

9. Assess Your Long-Term Needs

Credit cards should be viewed as long-term financial tools. Consider how the card will fit into your financial plan over time. For example:

- Can you maintain the minimum spending requirements for rewards? Some cards may have minimum spending thresholds to unlock higher-tier benefits.

- Do you expect your lifestyle to change? If you’re planning on significant life changes, like buying a house, having a child, or starting a business, your spending patterns may shift, making it worth reevaluating your credit card choices.

- Will you be traveling more in the future? If you expect to travel more in the future, a travel rewards card might become more valuable.

Conclusion

Choosing the right credit card is essential for optimizing your financial strategy and enhancing your purchasing power. It involves a careful balance between your personal financial goals, spending habits, and the benefits offered by various cards. By considering critical factors such as rewards programs, annual fees, interest rates, and additional perks, you can select a credit card that perfectly aligns with your lifestyle and maximizes the value you receive.

It’s important to remember that the best credit card for someone else may not necessarily be the best choice for you. Each individual’s financial situation is unique, so take the time to thoroughly evaluate your needs, preferences, and spending patterns. This approach will empower you to compare your options effectively and make an informed decision that supports your long-term financial well-being.

Ultimately, the right credit card can be a powerful tool in your financial arsenal, helping you earn rewards, save money on interest, and access exclusive benefits tailored to your lifestyle. Make sure to choose wisely and reap the rewards of your informed choice!